Презентация на тему: Retirement benefit in the Non-state Pension Provision System

Retirement benefit in the Non-state Pension Provision System Done by,a 3rd year law student.

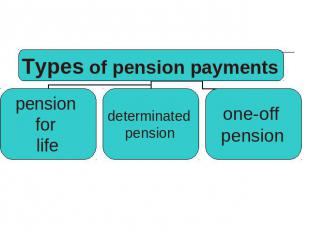

Contents Non-state Pension Provision System as form of incorporation in UkraineRetirement benefit in the Non-state Pension Provision System2.1. Pension for life . 2.2. Determinated pension2.3. One-off pension References

The non-state Pension Provision System is a component part of the accumulation pension provision system, which is based on principles of voluntarily participation of physical and legal persons in forming of pension accumulations with the purpose to receive by participators of the non-state pension provision system the additional to сompulsory state insurense retirement benefits.

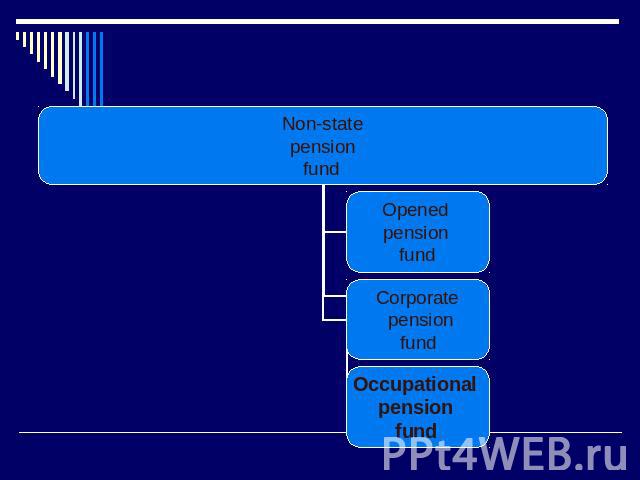

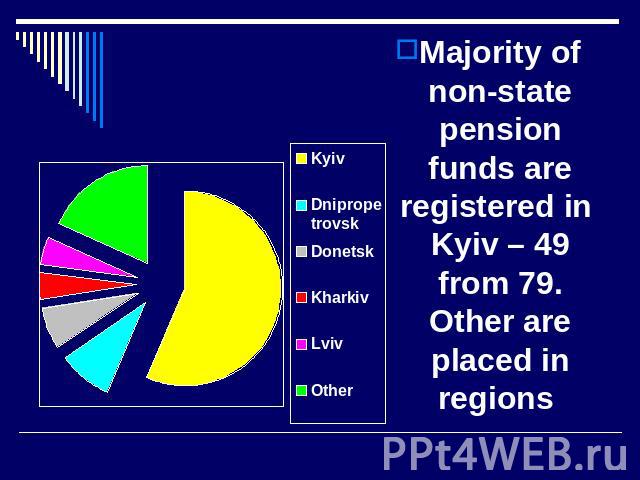

The information about 79 non-state pension funds, 63 of which – public, 10 corporate and 6 occupational non-state pension funds was insert to the State register of financial institutions.

Majority of non-state pension funds are registered in Kyiv – 49 from 79. Other are placed in regions

The system of the non-state pension providing is summon to create possibilities for keeping and increase the assets of depositors with the purpose of providing of receipt by them stable profit after attainment of retirement age.

References Alejandro Ferreiro Yazigi. The Chilean Pension System. Fourth Edition, May 2003. Santiago – Chile.- 212pp. Law of Ukraine “On compulsory state sosial retirement fee”of 26 June, 1997 Law of Ukraine is “On non-state pension provision” of 9 July, 2003. Sosial security law: Educational textbook for students of Higher Special Law Shcools // For editor of P. В. Pilipenko. Fundamental of Ukraine’s Legislation on Compulsory State Sosial System of 14 January, 1998 www.google.ua

THANK YOU FOR YOUR ATTENTION!