Презентация на тему: Interest Rates and Monetary Policy

Interest Rates and Monetary Policy McGraw-Hill/Irwin Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

Interest Rates The price paid for the use of moneyMany different interest ratesSpeak as if only one interest rateDetermined by the money supply and money demand LO1 33-*

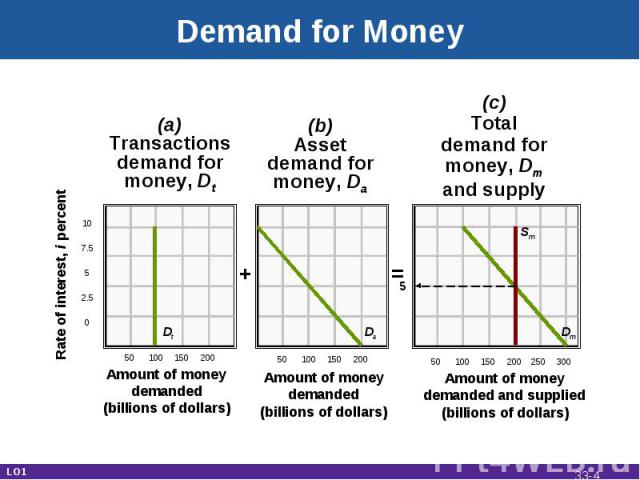

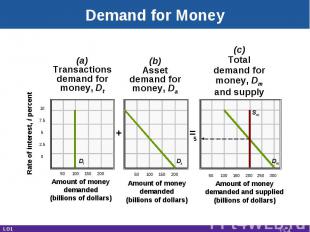

Demand for Money Why hold money?Transactions demand, DtDetermined by nominal GDPIndependent of the interest rateAsset demand, DaMoney as a store of valueVaries inversely with the interest rateTotal money demand, Dm LO1 33-*

Demand for Money Rate of interest, i percent 107.552.50 50 100 150 200 50 100 150 200 50 100 150 200 250 300 Amount of moneydemanded(billions of dollars) Amount of moneydemanded(billions of dollars) Amount of moneydemanded and supplied(billions of dollars) = + (a)Transactionsdemand formoney, Dt (b)Assetdemand formoney, Da (c)Totaldemand formoney, Dmand supply Dt Da Dm Sm 5 LO1 33-*

AssetsSecuritiesLoans to commercial banksLiabilitiesReserves of commercial banksTreasury depositsFederal Reserve Notes outstanding LO2 Federal Reserve Balance Sheet 33-*

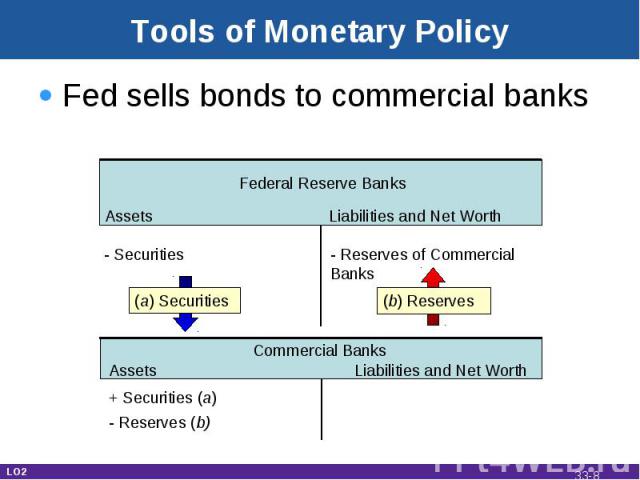

Tools of Monetary Policy Open market operationsBuying and selling of government securities (or bonds)Commercial banks and the general publicUsed to influence the money supplyWhen the Fed sells securities, commercial bank reserves are reduced LO2 33-*

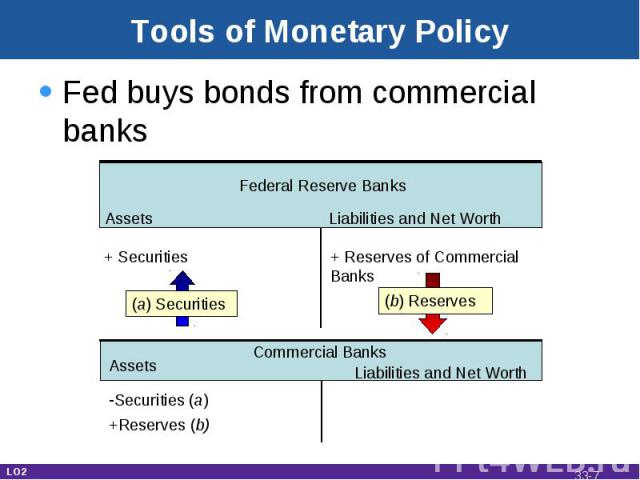

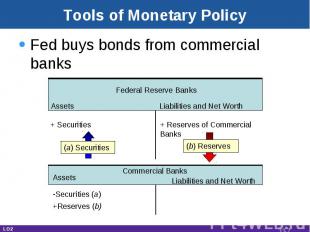

Tools of Monetary Policy Fed buys bonds from commercial banks Assets Liabilities and Net Worth Federal Reserve Banks + Securities + Reserves of Commercial Banks (b) Reserves Commercial Banks Securities (a) +Reserves (b) Assets Liabilities and Net Worth LO2 (a) Securities 33-*

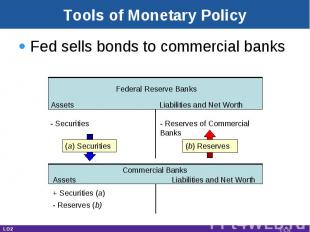

Tools of Monetary Policy Fed sells bonds to commercial banks Assets Liabilities and Net Worth Federal Reserve Banks - Securities - Reserves of Commercial Banks Commercial Banks + Securities (a) - Reserves (b) Assets Liabilities and Net Worth (a) Securities (b) Reserves LO2 33-*

Tools of Monetary Policy The reserve ratioChanges the money multiplierThe discount rateThe Fed as lender of last resortShort term loansTerm auction facilityIntroduced December 2007Banks bid for the right to borrow reserves LO2 33-*

Tools of Monetary Policy Open market operations are the most importantReserve ratio last changed in 1992Discount rate was a passive toolTerm auction facility is newGuaranteed amount lent by the FedAnonymous LO2 33-*

The Federal Funds Rate Rate charged by banks on overnight loansTargeted by the Federal ReserveFOMC conducts open market operations to achieve the targetDemand curve for Federal fundsSupply curve for Federal funds LO3 33-*

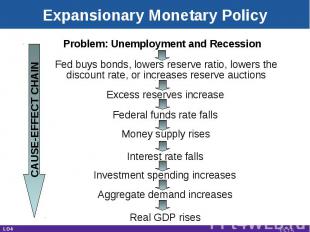

Monetary Policy Expansionary monetary policyEconomy faces a recessionLower target for Federal funds rateFed buys securities Expanded money supplyDownward pressure on other interest rates LO3 33-*

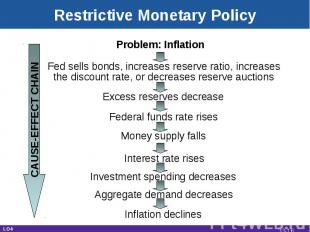

Monetary Policy Restrictive monetary policyPeriods of rising inflationIncreases Federal funds rateIncreases money supplyIncreases other interest rates LO3 33-*

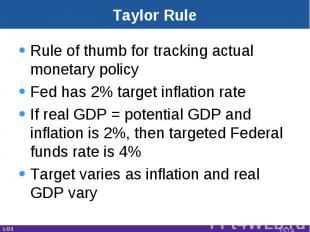

Taylor Rule Rule of thumb for tracking actual monetary policyFed has 2% target inflation rateIf real GDP = potential GDP and inflation is 2%, then targeted Federal funds rate is 4%Target varies as inflation and real GDP vary LO3 33-*

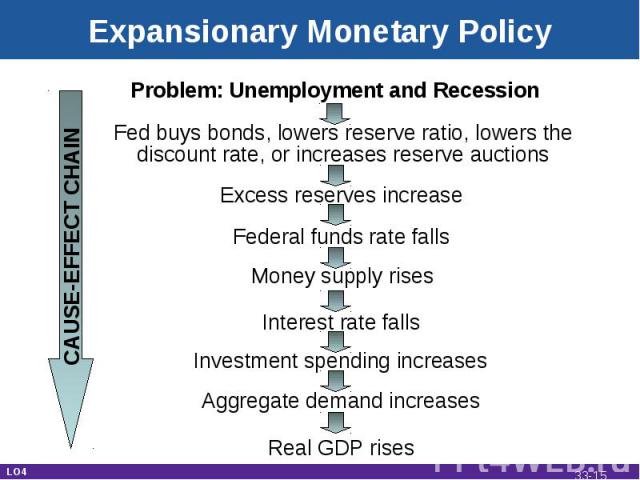

Expansionary Monetary Policy Problem: Unemployment and Recession Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls Investment spending increases Aggregate demand increases Real GDP rises LO4 CAUSE-EFFECT CHAIN 33-*

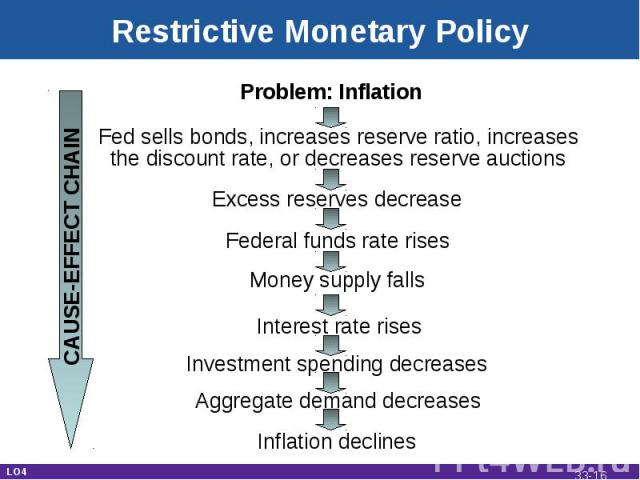

Restrictive Monetary Policy Problem: Inflation Fed sells bonds, increases reserve ratio, increases the discount rate, or decreases reserve auctions Excess reserves decrease Federal funds rate rises Money supply falls Interest rate rises Investment spending decreases Aggregate demand decreases Inflation declines CAUSE-EFFECT CHAIN LO4 33-*

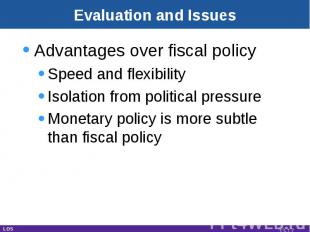

Evaluation and Issues Advantages over fiscal policySpeed and flexibilityIsolation from political pressureMonetary policy is more subtle than fiscal policy LO5 33-*

Problems and Complications LagsRecognition and operationalCyclical asymmetryLiquidity trap LO5 33-*