Презентация на тему: Lecture

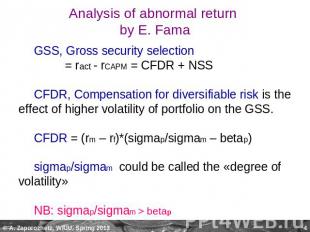

LectureAnalysis of abnormal return of managed portfolios by E. Fama.GSS. CFDR. NSS.

Eugene Fama Born in 1939, an American economist, known for his work on portfolio theory and asset pricing, both theoretical and empirical. Currently he is a professor of finance at the University of Chicago Booth School of Business. MBA, PhD.

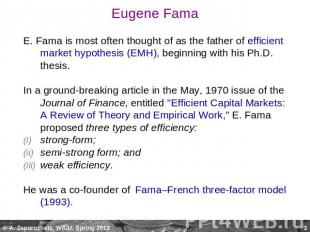

Eugene Fama E. Fama is most often thought of as the father of efficient market hypothesis (EMH), beginning with his Ph.D. thesis. In a ground-breaking article in the May, 1970 issue of the Journal of Finance, entitled "Efficient Capital Markets: A Review of Theory and Empirical Work," E. Fama proposed three types of efficiency: strong-form; semi-strong form; and weak efficiency. He was a co-founder of Fama–French three-factor model (1993).

Analysis of abnormal return by E. Fama GSS, Gross security selection = ract - rCAPM = CFDR + NSSCFDR, Compensation for diversifiable risk is the effect of higher volatility of portfolio on the GSS. CFDR = (rm – rf)*(sigmap/sigmam – betap)sigmap/sigmam could be called the «degree of volatility»NB: sigmap/sigmam > betap

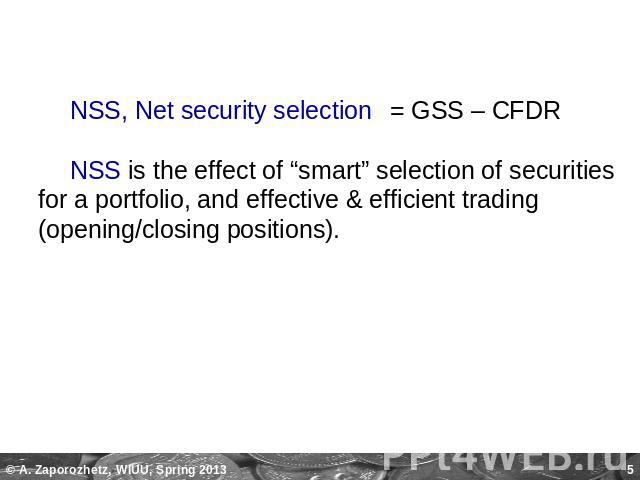

NSS, Net security selection= GSS – CFDR NSS is the effect of “smart” selection of securities for a portfolio, and effective & efficient trading (opening/closing positions).

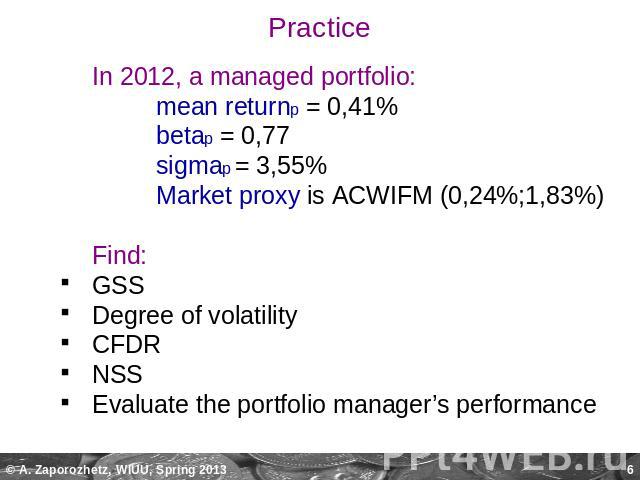

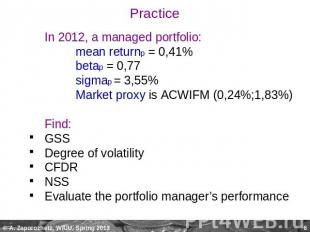

In 2012, a managed portfolio: mean returnp = 0,41% betap = 0,77 sigmap = 3,55%Market proxy is ACWIFM (0,24%;1,83%)Find: GSSDegree of volatilityCFDRNSSEvaluate the portfolio manager’s performance

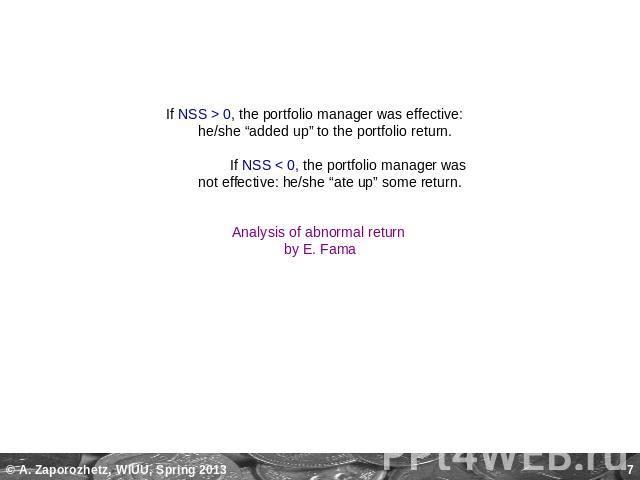

If NSS > 0, the portfolio manager was effective: he/she “added up” to the portfolio return. If NSS < 0, the portfolio manager was not effective: he/she “ate up” some return. Analysis of abnormal return by E. Fama