Презентация на тему: Banking System of Great Britain

Banking System of Great Britain

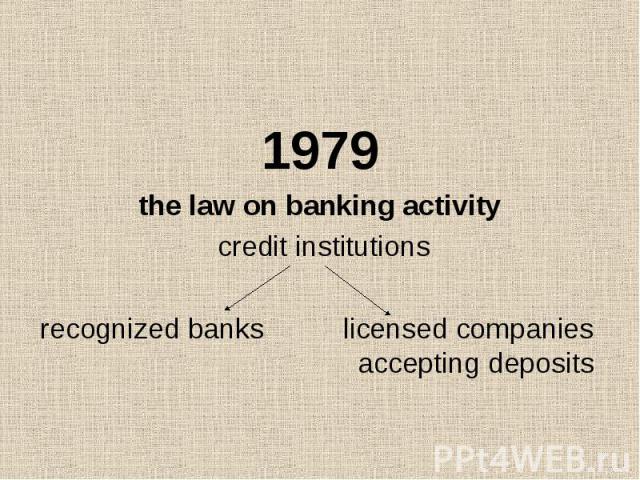

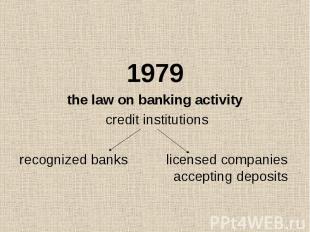

1979 the law on banking activity credit institutions recognized banks licensed companies accepting deposits

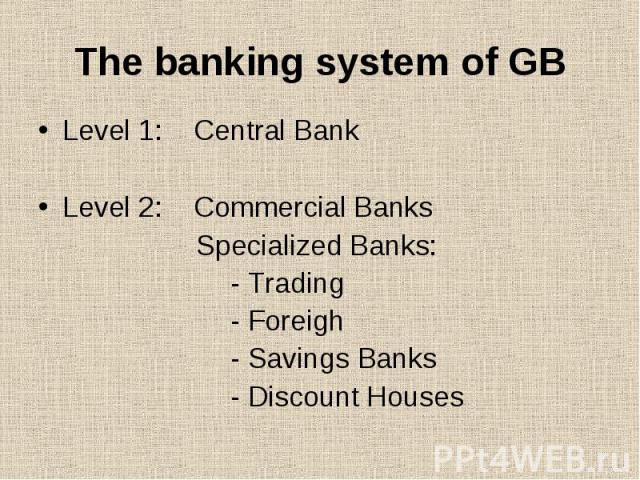

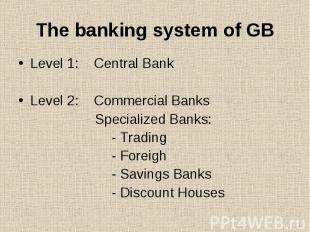

The banking system of GB Level 1: Central Bank Level 2: Commercial Banks Specialized Banks: - Trading - Foreigh - Savings Banks - Discount Houses

Central Bank of Great Britain Bank of England Founded in 1694 1268 shareholders 1200 pounds Nationalized in 1946

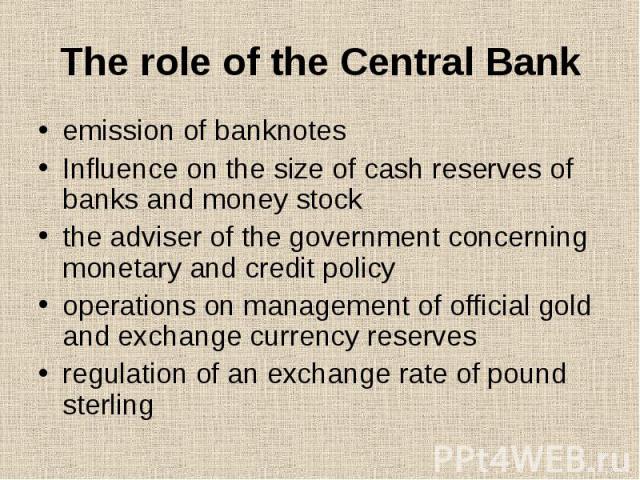

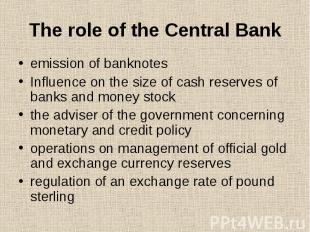

The role of the Central Bank emission of banknotes Influence on the size of cash reserves of banks and money stock the adviser of the government concerning monetary and credit policy operations on management of official gold and exchange currency reserves regulation of an exchange rate of pound sterling

Supervision of banking system Accounts of other banks Accounts of the government and the governmental departments Management of a public debt

Commercial Banks “the great four”: National Westminster Barclays RBS Lloyds

Passive operations: reception of deposits: - deposits at call - deposit accounts - savings deposits

Active operations: dicount loans investments in securities

Specialized banks Trading banks Foreign banks Savings banks