Презентация на тему: Global Financial Crisis (GFC) or the "Great Recession“

Rostov-on-DonDepartment of educationGymnasium 34Vladislav PismenskiyForm 10 “Б”Research project in English ScienceTopic : Global Financial Crisis (GFC) or the "Great Recession“Project supervisor : Dolgopolskaya I.B.2012

The notion of economic crisisGeneral groundsCauses of the crisisImpact on financial marketsGlobal effectsStabilizationEconomic forecasting and media coverageConclusion

Global Financial Crisis (GFC) is claimed to be the worst financial crisis since the Great Depression of the 1930s by many economists.

There is hardly ever any sphere of society that GFC didn’t touch. That’s why changes both in global economic relations and in the economy of a definite state and defining of the directions of further economic development have become urgent.

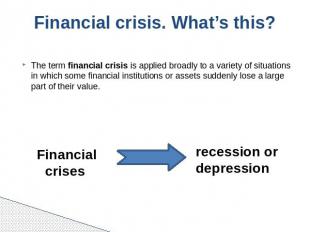

Financial crisis. What’s this? The term financial crisis is applied broadly to a variety of situations in which some financial institutions or assets suddenly lose a large part of their value. Financial crises recession or depression

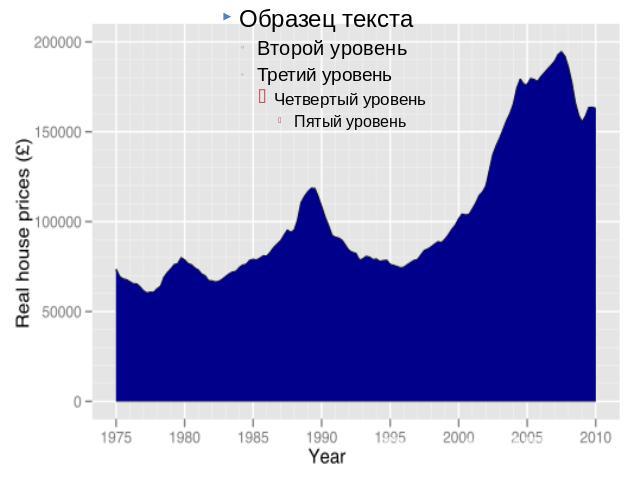

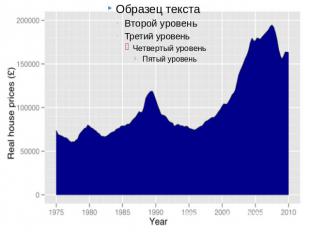

The source of financial crisis of 2008 lies in the banking system of the USA. It concerned valuation and liquidity problems but the roots go back to 2007 which is considered to be the peak of housing bubble.

Causes

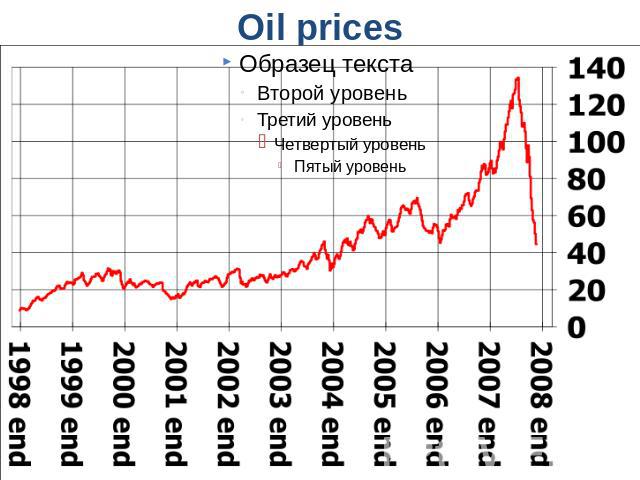

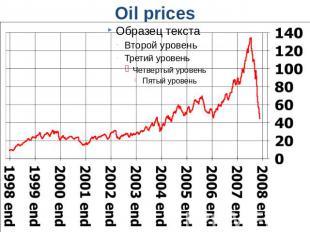

Oil prices

Impact on the financial markets The International Monetary Fund estimated that large U.S. and European banks lost more than $1 trillion on toxic assets and from bad loans from January 2007 to September 2009. One of the first victims was Northern Rock, a medium-sized British bank.

List of largest U.S. bank failures

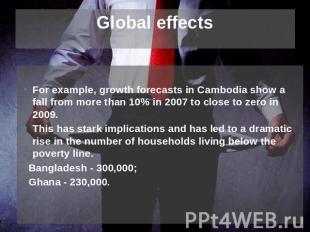

Global effects For example, growth forecasts in Cambodia show a fall from more than 10% in 2007 to close to zero in 2009.This has stark implications and has led to a dramatic rise in the number of households living below the poverty line. Bangladesh - 300,000; Ghana - 230,000.

The recession that began in December 2007 ended in June 2009, according to U.S. National Bureau of Economic Research (NBER) and the financial crisis appears to have ended about the same time.Nevertheless, the lack of fundamental changes in banking and financial markets, worries many market participants, including the International Monetary Fund.

Role of economic forecasting The financial crisis was not widely predicted by mainstream economists, who instead spoke of the Great Moderation. A number of economists predicted the crisis, with varying arguments.A cover story in BusinessWeek magazine claims that economists mostly failed to predict the worst international economic crisis since the Great Depression of 1930s.Within mainstream financial economics, most believe that financial crises are simply unpredictable.Lebanese-American trader and financial risk engineer Nassim Nicholas Taleb warned against the breakdown of the banking system in particular and the economy in general owing to their use of bad risk models and reliance on forecasting and framed the problem as part of "robustness and fragility".

Mass media focused great attention to the world financial crises. It has generated many articles, books, films etc. Trying to find the reason, the ways out of the crisis and those who are to blame for it. For example, Time Magazine named "25 People to Blame for the Financial Crisis"

Emerging and developing economies drive global economic growth

Joint action of financial and political authorities November 14, 2008 Leaders of the Group of Twenty (G20) gathered at an anti-crisis summit. Following the working session, the summit adopted a declaration in which general principles for reform of financial markets, the restructuring of international financial institutions, the obligation to refrain from the use of protectionist measures were proclaimed.

Summing up, the investigation outlined the reasons of the crisis and its consequences and mainly the fact that the stabilization and further development of financial market is possible only by joint efforts of all the leading economies.But the crisis turned out to be not so deep and the global financial system didn’t undergo crucial changes thanks to the interference of the state into the financial market.Though, not all the reasons were done away with economies of leading states still live under threat of the following crises.

Thank you for your attention!