Презентация на тему: Global Economic Crisis and Belarus

Global Economic Crisis and Belarus

CONTENTS IntroductionMacroeconomic and market situationCrisis’s consequencesa) Devaluation of Belarusian rubleb) Social issuesWays off

INTRODUCTION At first glance, it seems that Belarus’ recent economic performance surprised most outside observers. According to official statistics, economic growth in Belarus between January and June 2009 amounted to a 0.3% increase year-on-year, while Russia’s economy – a major market for Belarusian industrial exports – dropped by 10.1% year-by-year. Comparison of the country’s previous economic performance illustrates the negative impact of the crisis. A decrease of external demand hit Belarusian industry and increased external imbalances, while the fall of energy prices and deterioration of enterprises deteriorated government revenues. All of these factors unveiled structural problems that required appropriate action. Instead, the government has chosen to delay “radical” reforms by borrowing abroad.

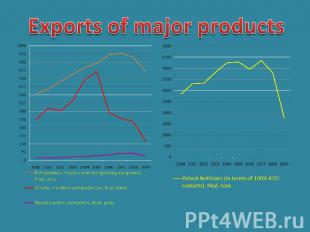

Macroeconomicand market situation The rapid decrease of external demand in Belarus is a major consequence of the global economic crisis. The decline in industrial demand resulted in increased inventories (finished good and stock). As a result, between January and May of 2009, Belarusian merchandise exports dropped by 48% year-on-year.

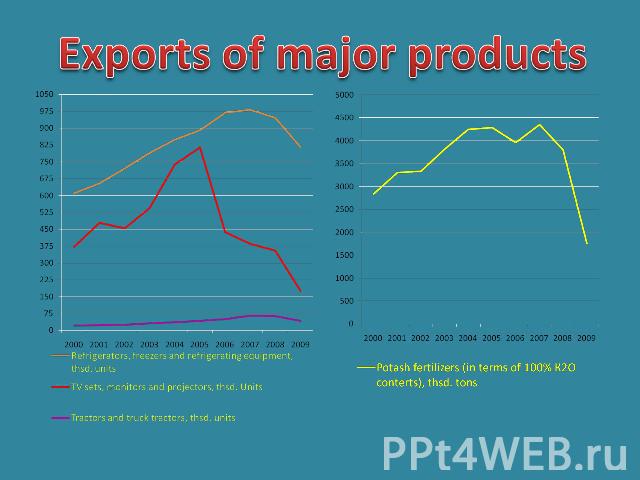

Exports of major products

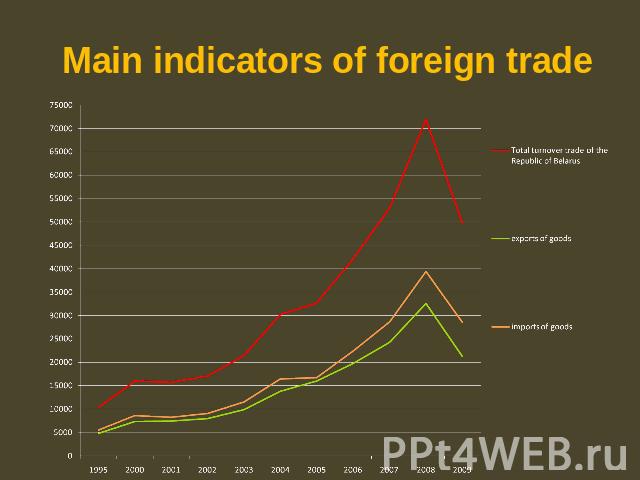

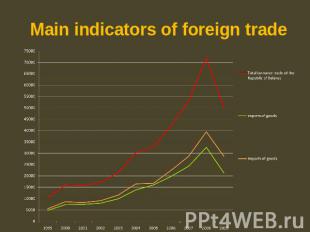

Macroeconomicand market situation Taking into account the existing relationship between export and import volumes (1% to 0.64%), the contraction of Belarusian exports should result in a growing trade deficit (see diagram).

Main indicators of foreign trade

Crisis’s consequences. Devaluation of Belarusian Ruble Growing external imbalances forced the government to revise exchange rate policy. The devaluation was required by the IMF. Despite the measure, this devaluation has not been followed by a restriction in domestic demand,

Crisis’s consequences. Devaluation of Belarusian Ruble Thus the current account deficit persists. The main reason for exchange rate instability – the current account deficit. Here you can see the basic measures accepted by the Belarus authorities. They are:

Crisis’s consequences andSocial issues The potential increase of poverty creates challenges for social policy, due to a drastic of government revenues and poor identification of vulnerable groups, especially unemployed and low-paid workers. The main “social” choice for the government is between hidden and open unemployment. Efficient privatization is another possible solution, although it would require firing excess labor. It would create new work places and generate revenues for social support.

Ways off Loans and solution Reforms asa remedy

Ways off Loans and solution.Belarus was among the first transition economies to ask for an International Monetary Fund (IMF) stand-by loan. As a great part of the loan agreement the Fund expects the Belarusian government to promote father liberalization efforts which includes preparing the economy for privatization, as well as implementing some structural changes deemed “essential to improve prospects for long-run growth and external stability”.

Ways off Reforms as a remedy At the moment, the shape of this “revised” economic program is not clear. However, the previous version, approved at the end of 2008, included several measures which can be viewed as improving liberalization efforts – including prices, wages, and doing business. After recent discussions with the IMF and World Bank it seems that Belarusian authorities are ready to launch large scale all of for privatization efforts. Evidently, these measures are good for growth in the medium to long- term, but the question remains: will they solve the country’s short-term economic problems?

Thanks for attention!