Презентация на тему: Forms of Business

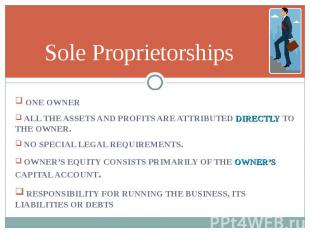

ONE OWNER ONE OWNER ALL THE ASSETS AND PROFITS ARE ATTRIBUTED DIRECTLY TO THE OWNER. NO SPECIAL LEGAL REQUIREMENTS. OWNER’S EQUITY CONSISTS PRIMARILY OF THE OWNER’S CAPITAL ACCOUNT. RESPONSIBILITY FOR RUNNING THE BUSINESS, ITS LIABILITIES OR DEBTS

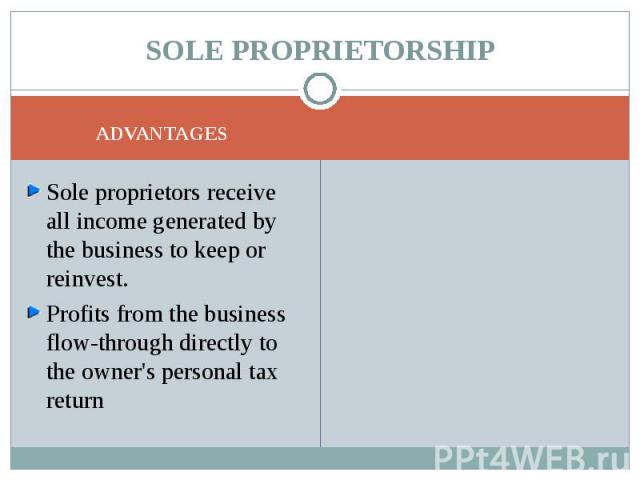

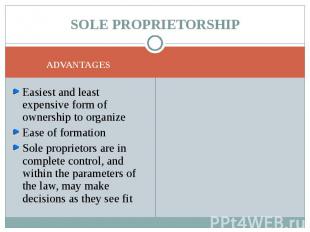

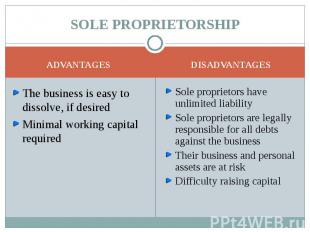

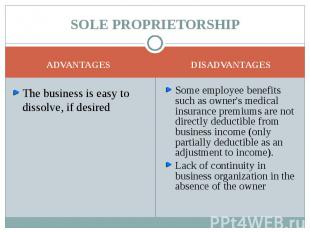

ADVANTAGES ADVANTAGES

ADVANTAGES ADVANTAGES

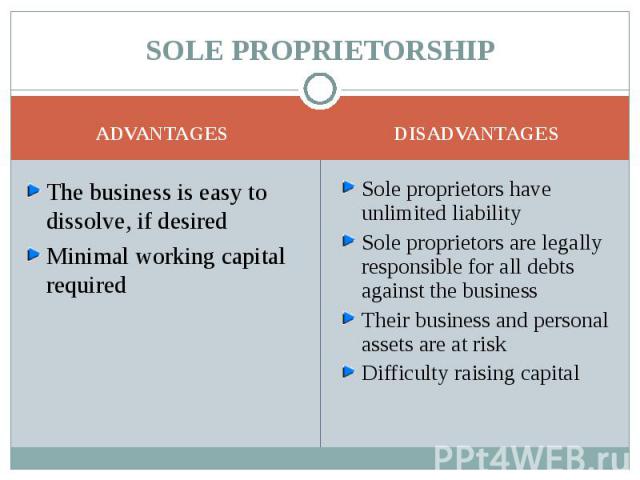

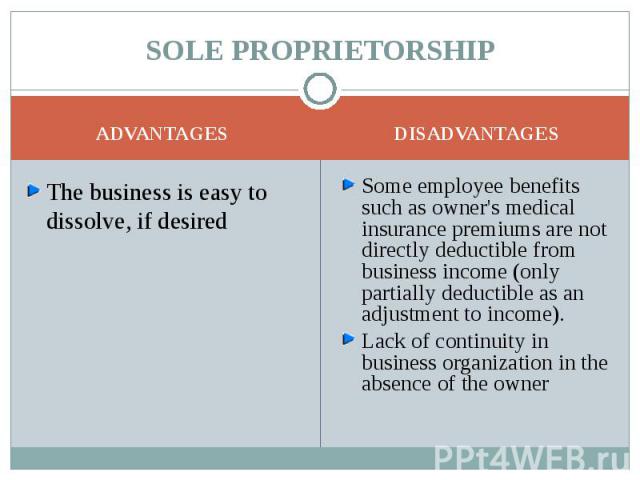

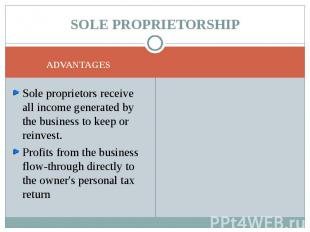

ADVANTAGES ADVANTAGES

ADVANTAGES ADVANTAGES

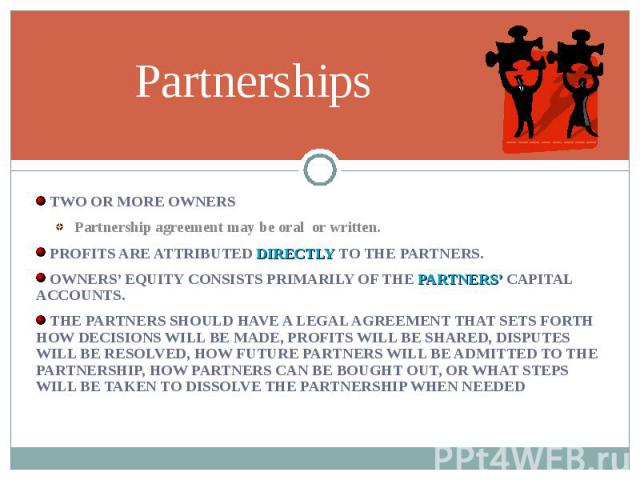

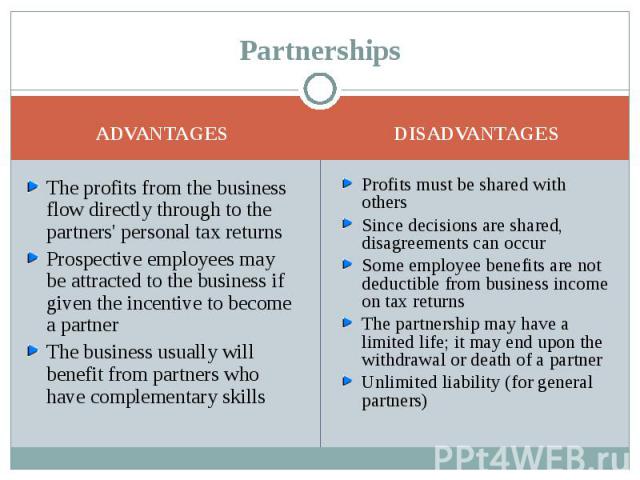

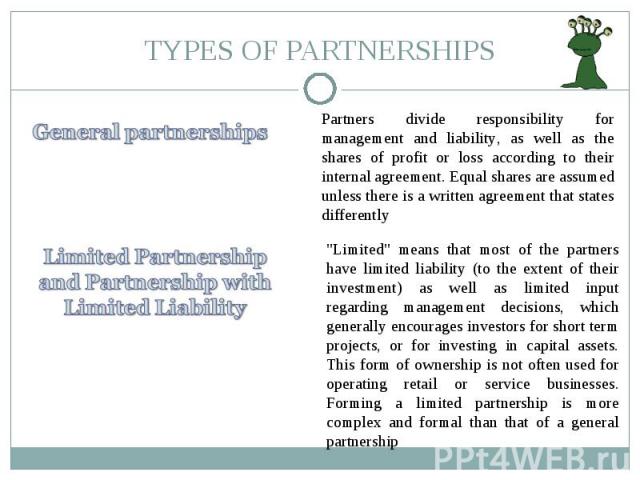

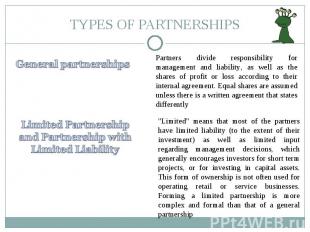

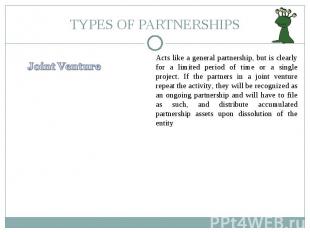

TWO OR MORE OWNERS TWO OR MORE OWNERS Partnership agreement may be oral or written. PROFITS ARE ATTRIBUTED DIRECTLY TO THE PARTNERS. OWNERS’ EQUITY CONSISTS PRIMARILY OF THE PARTNERS’ CAPITAL ACCOUNTS. THE PARTNERS SHOULD HAVE A LEGAL AGREEMENT THAT SETS FORTH HOW DECISIONS WILL BE MADE, PROFITS WILL BE SHARED, DISPUTES WILL BE RESOLVED, HOW FUTURE PARTNERS WILL BE ADMITTED TO THE PARTNERSHIP, HOW PARTNERS CAN BE BOUGHT OUT, OR WHAT STEPS WILL BE TAKEN TO DISSOLVE THE PARTNERSHIP WHEN NEEDED

THE PARTNERS MUST DECIDE UP FRONT HOW MUCH TIME AND CAPITAL EACH WILL CONTRIBUTE THE PARTNERS MUST DECIDE UP FRONT HOW MUCH TIME AND CAPITAL EACH WILL CONTRIBUTE

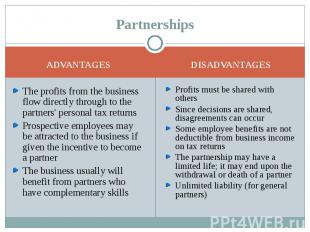

ADVANTAGES ADVANTAGES

ADVANTAGES ADVANTAGES

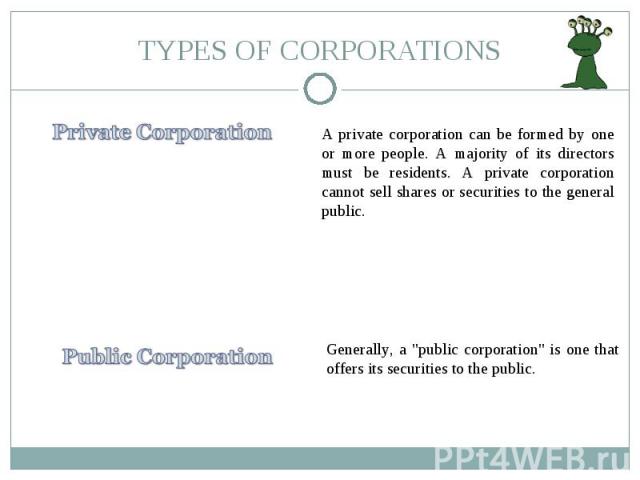

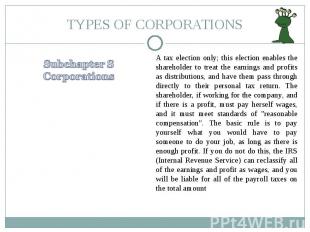

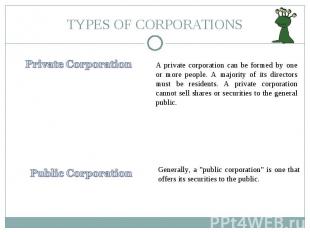

A CORPORATION IS IDENTIFIED BY THE TERMS "LIMITED", "LTD.", "INCORPORATED", "INC.", "CORPORATION", OR "CORP.". A CORPORATION IS IDENTIFIED BY THE TERMS "LIMITED", "LTD.", "INCORPORATED", "INC.", "CORPORATION", OR "CORP.". WHATEVER THE TERM, IT MUST APPEAR WITH THE CORPORATE NAME ON ALL DOCUMENTS, STATIONERY, AND SO ON, AS IT APPEARS ON THE INCORPORATION DOCUMENT

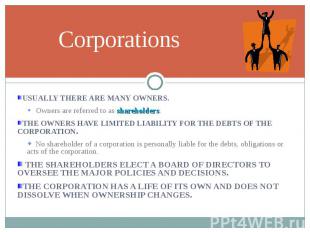

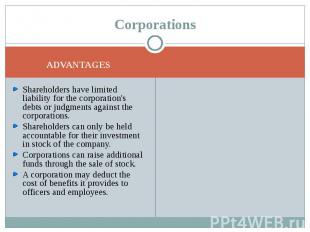

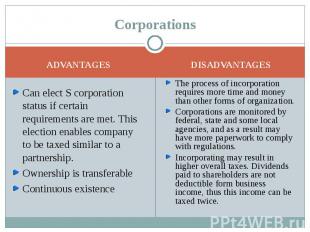

USUALLY THERE ARE MANY OWNERS. USUALLY THERE ARE MANY OWNERS. Owners are referred to as shareholders. THE OWNERS HAVE LIMITED LIABILITY FOR THE DEBTS OF THE CORPORATION. No shareholder of a corporation is personally liable for the debts, obligations or acts of the corporation. THE SHAREHOLDERS ELECT A BOARD OF DIRECTORS TO OVERSEE THE MAJOR POLICIES AND DECISIONS. THE CORPORATION HAS A LIFE OF ITS OWN AND DOES NOT DISSOLVE WHEN OWNERSHIP CHANGES.

ADVANTAGES ADVANTAGES

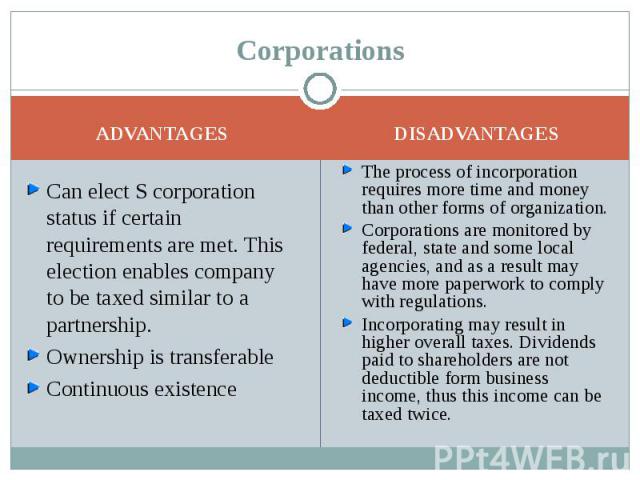

ADVANTAGES ADVANTAGES

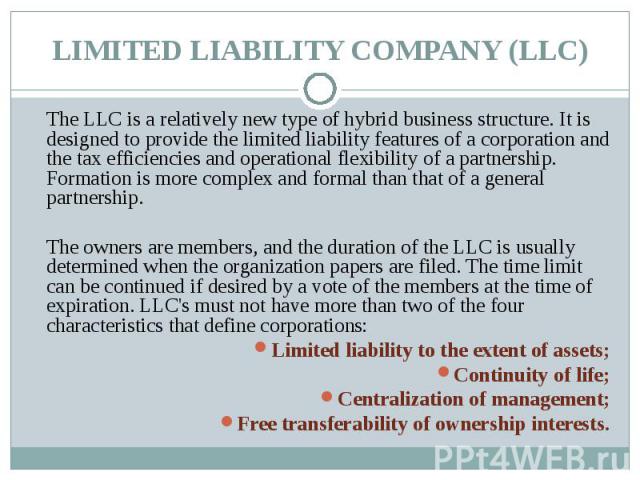

The LLC is a relatively new type of hybrid business structure. It is designed to provide the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Formation is more complex and formal than that of a general partnership. The LLC is a relatively new type of hybrid business structure. It is designed to provide the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Formation is more complex and formal than that of a general partnership. The owners are members, and the duration of the LLC is usually determined when the organization papers are filed. The time limit can be continued if desired by a vote of the members at the time of expiration. LLC's must not have more than two of the four characteristics that define corporations: Limited liability to the extent of assets; Continuity of life; Centralization of management; Free transferability of ownership interests.