Презентация на тему: Дисней

Shanghai Disneyland February 24, 2003 BA 456

Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

The Walt Disney Company Entertainment Conglomerate consisting of Media, Studio Entertainment, Consumer Products and Theme Parks & Resorts Theme Park & Resorts Division Current Park Locations: Anaheim, Orlando, Tokyo, Paris, Hong Kong (2005) Also includes: The Disney Cruise Line, Disney Regional Entertainment, The Disney Vacation Club, The Anaheim Angels, and the Mighty Ducks of Anaheim Revenues of $7 Billion in 2001, or 28% of company-wide revenue

Disney’s Interest in China Long-term Consistently searching for areas of expansion where there are un-captured markets Current Government relations established through the Hong Kong Disneyland project indicate easier entry into the mainland Competitive Universal-Vivendi’s land purchase in Shanghai and proposed expansion into Beijing

Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

Background: Disney Parks Disneyland, Anaheim: 1955 Walt Disney World, Orlando: 1971 Tokyo Disneyland:1983 Owned and operated by the Oriental Land Company Deal structure indicative of financial turmoil within the company in the early 1980s with a 0% Equity stake Revenue from royalties and management fees Disneyland Paris/Euro Disneyland: 1992 Disney retains 39% of Equity Interest and receives management fees as part of reported revenue

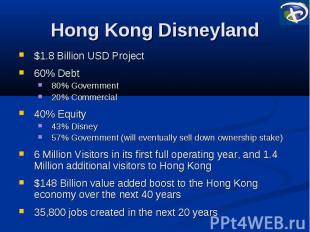

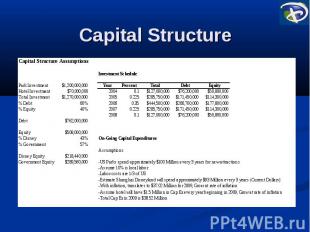

Hong Kong Disneyland $1.8 Billion USD Project 60% Debt 80% Government 20% Commercial 40% Equity 43% Disney 57% Government (will eventually sell down ownership stake) 6 Million Visitors in its first full operating year, and 1.4 Million additional visitors to Hong Kong $148 Billion value added boost to the Hong Kong economy over the next 40 years 35,800 jobs created in the next 20 years

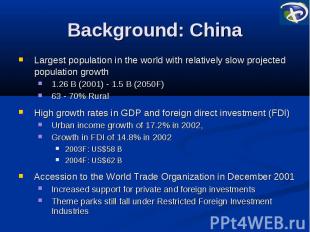

Background: China Largest population in the world with relatively slow projected population growth 1.26 B (2001) - 1.5 B (2050F) 63 - 70% Rural High growth rates in GDP and foreign direct investment (FDI) Urban income growth of 17.2% in 2002, Growth in FDI of 14.8% in 2002 2003F: US$58 B 2004F: US$62 B Accession to the World Trade Organization in December 2001 Increased support for private and foreign investments Theme parks still fall under Restricted Foreign Investment Industries

Theme Parks in China Most parks in China were American-themed Few have survived mainly because of transportation issues Admission Prices: 56 – 100 yuan ($6 – $12) Park Sizes: 70 – 150 acres Universal-Vivendi December 2002 agreement to build a park in Shanghai Projected park opening in 2006, with more than 8 million visitors in the first year In discussions to build a similar park in Beijing

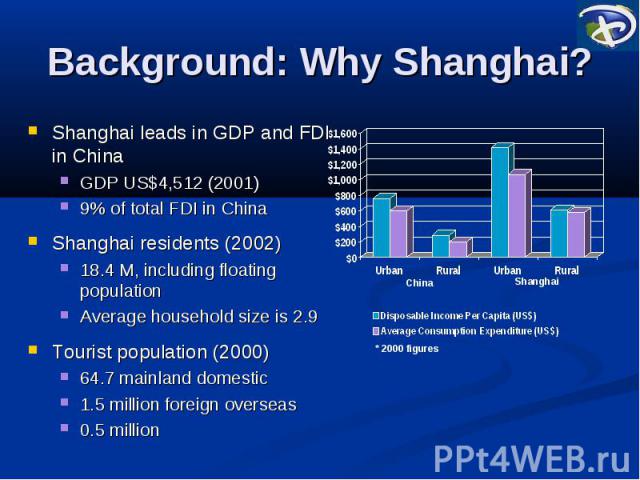

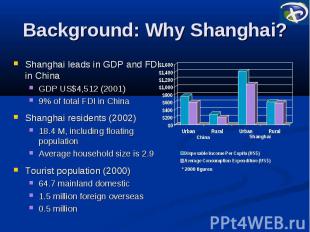

Background: Why Shanghai? Shanghai leads in GDP and FDI in China GDP US$4,512 (2001) 9% of total FDI in China Shanghai residents (2002) 18.4 M, including floating population Average household size is 2.9 Tourist population (2000) 64.7 mainland domestic 1.5 million foreign overseas 0.5 million

Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

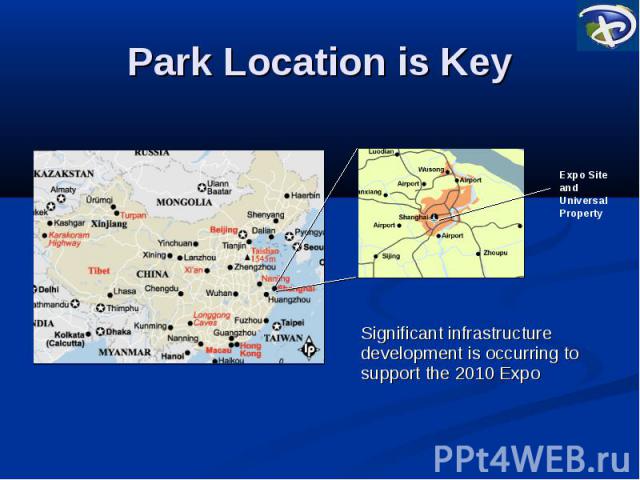

Park Location is Key

Target Market

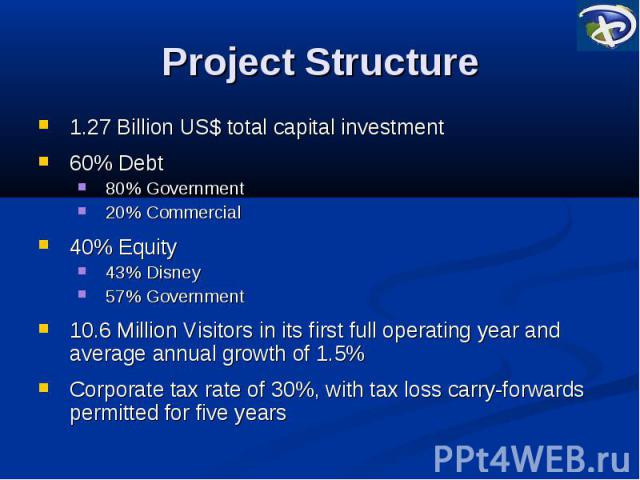

Project Structure

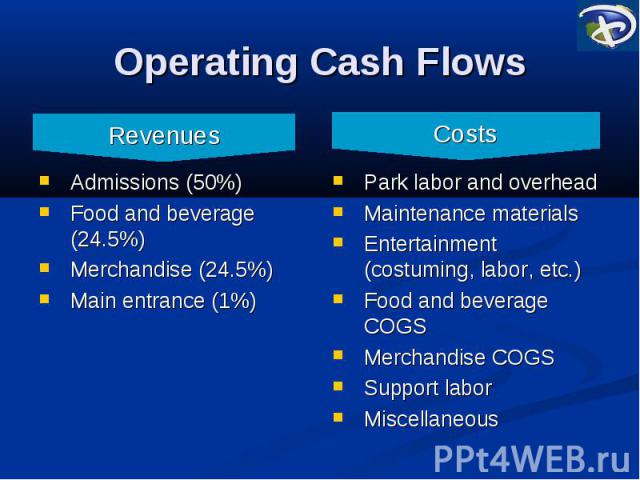

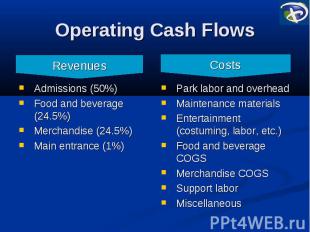

Operating Cash Flows Admissions (50%) Food and beverage (24.5%) Merchandise (24.5%) Main entrance (1%)

Discussion

Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

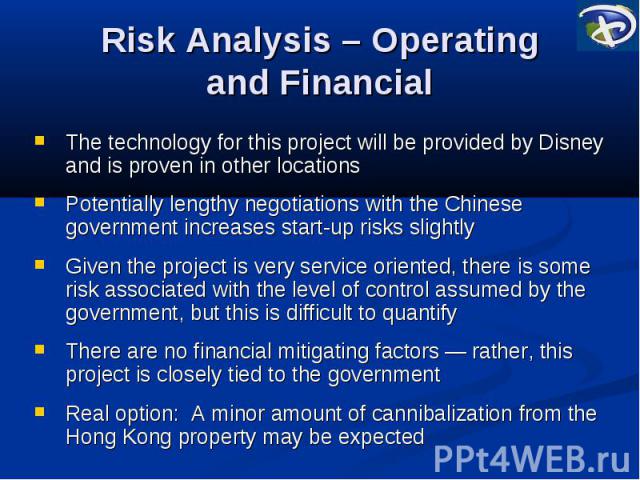

Risk Analysis - Sovereign Currency risk is not mitigated by this project since the majority of cash inflows and outflows are in local currency Expropriation risk is mitigated some with the government taking a controlling equity stake No other commercial or multi-lateral agency partners are involved in the project Because the project is in the tourism industry and involves an American cultural icon, the susceptibility to strikes or terrorism is slightly higher than average The project’s location in Shanghai reduces the overall risk of natural disasters when compared to country averages

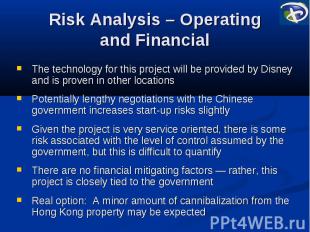

Risk Analysis – Operating and Financial The technology for this project will be provided by Disney and is proven in other locations Potentially lengthy negotiations with the Chinese government increases start-up risks slightly Given the project is very service oriented, there is some risk associated with the level of control assumed by the government, but this is difficult to quantify There are no financial mitigating factors ― rather, this project is closely tied to the government Real option: A minor amount of cannibalization from the Hong Kong property may be expected

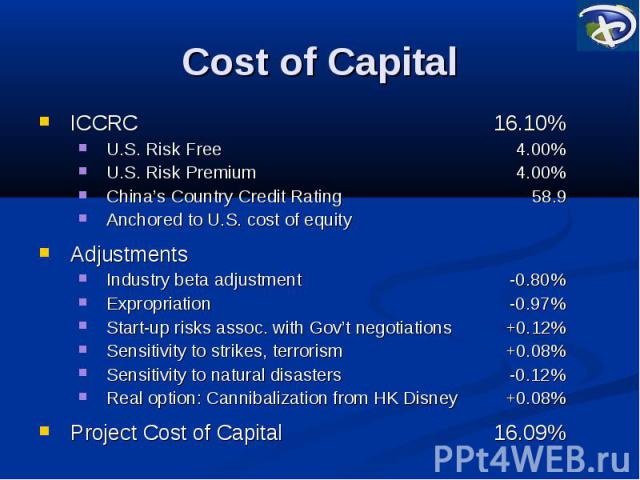

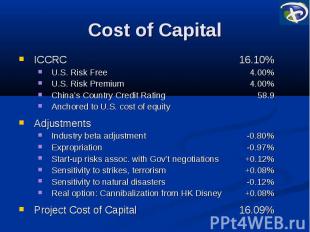

Cost of Capital ICCRC 16.10% U.S. Risk Free 4.00% U.S. Risk Premium 4.00% China’s Country Credit Rating 58.9 Anchored to U.S. cost of equity Adjustments Industry beta adjustment -0.80% Expropriation -0.97% Start-up risks assoc. with Gov’t negotiations +0.12% Sensitivity to strikes, terrorism +0.08% Sensitivity to natural disasters -0.12% Real option: Cannibalization from HK Disney +0.08% Project Cost of Capital 16.09%

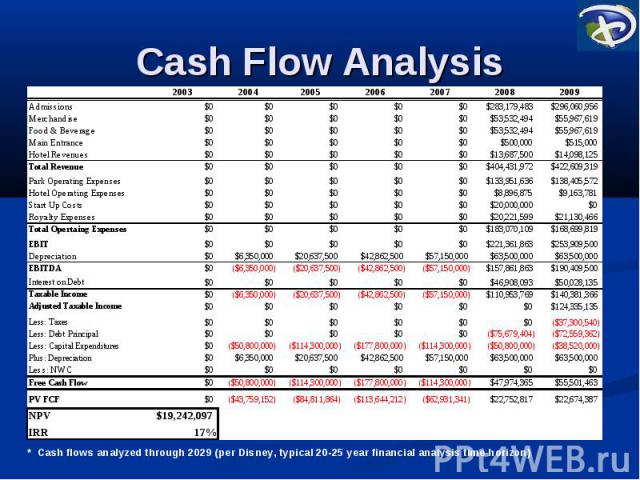

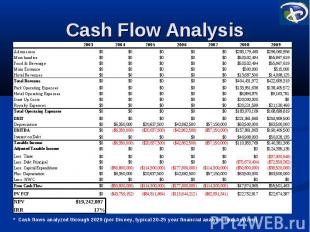

Cash Flow Analysis

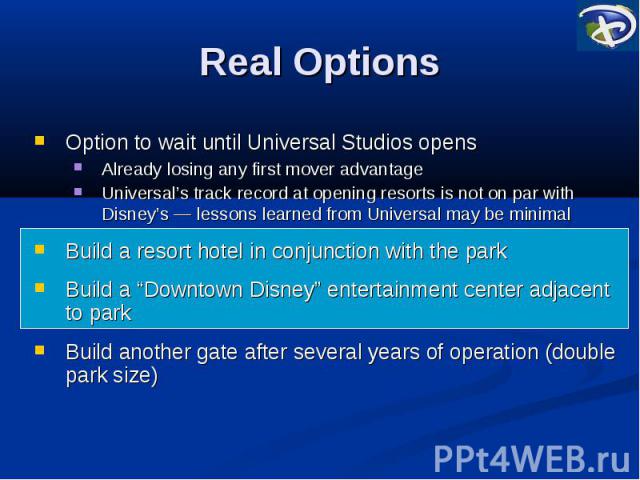

Real Options Option to wait until Universal Studios opens Already losing any first mover advantage Universal’s track record at opening resorts is not on par with Disney’s ― lessons learned from Universal may be minimal Build a resort hotel in conjunction with the park Build a “Downtown Disney” entertainment center adjacent to park Build another gate after several years of operation (double park size)

Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

Recommendation Begin negotiations with Chinese government Government equity stake and debt provisions Land and infrastructure provisions Disney must make the argument that a Shanghai Park would not substantially damage Hong Kong Escalating political tensions on the Korean peninsula could change the risk assessment

Questions?

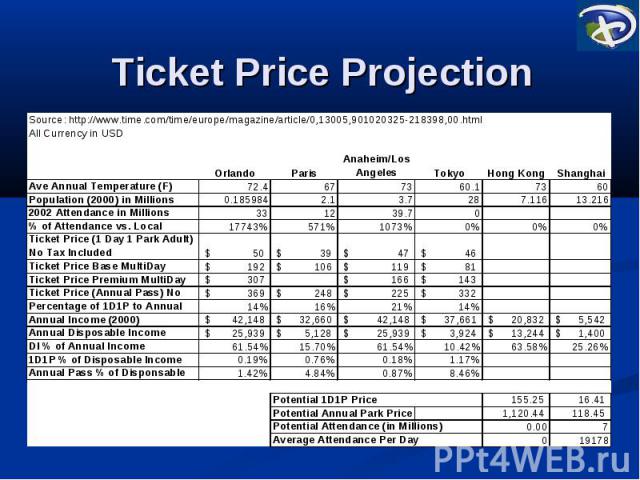

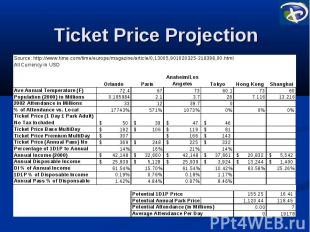

Ticket Price Projection

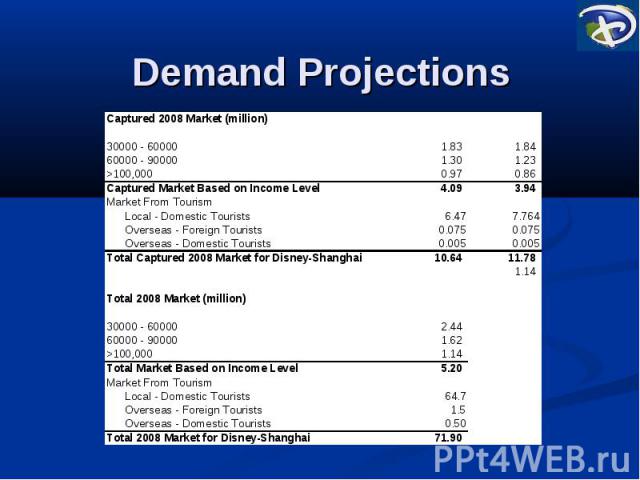

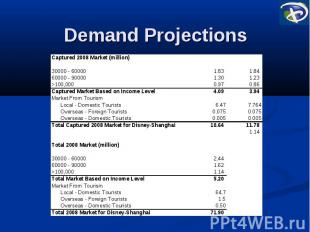

Demand Projections

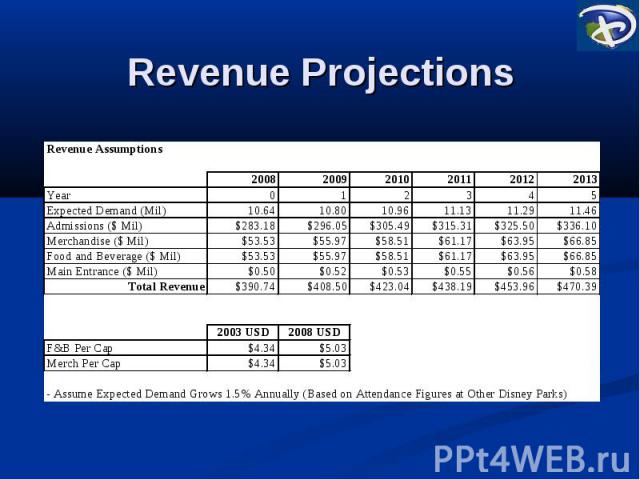

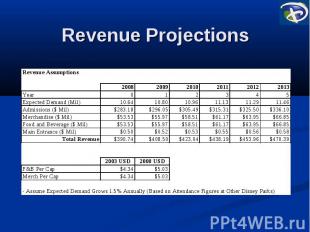

Revenue Projections

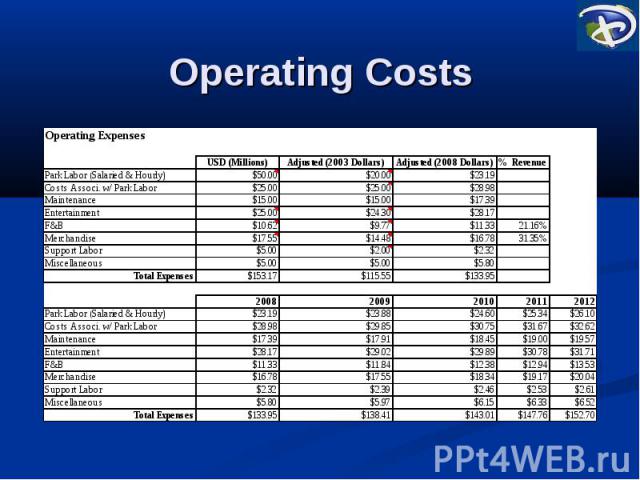

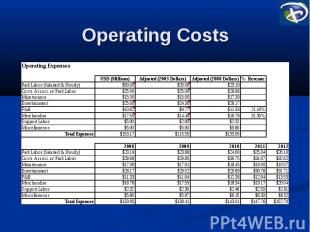

Operating Costs

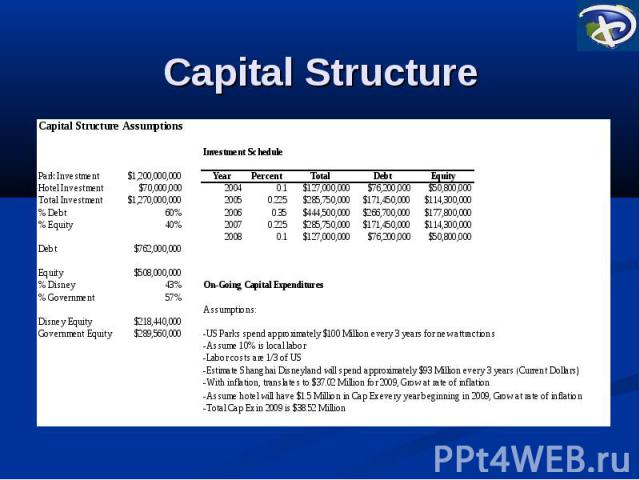

Capital Structure

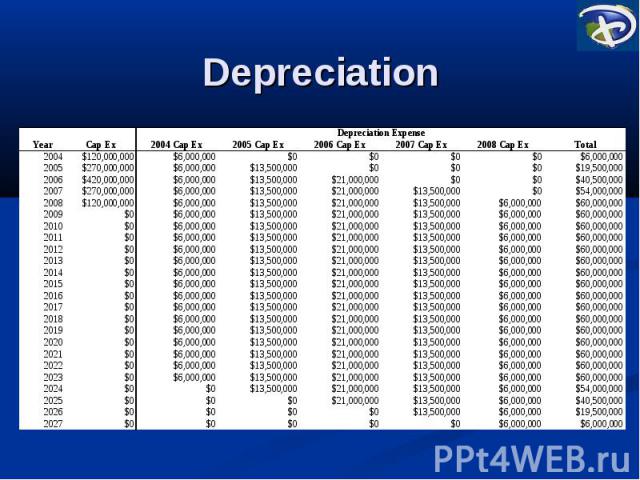

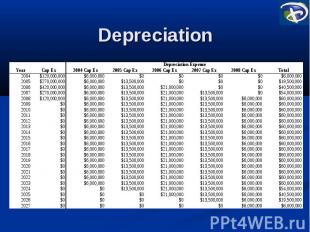

Depreciation